Quickbooks UK - accounting software

QuickBooks UK for sole traders as well as limited-company and expanding teams. We will help you select the best plan for you to set up the system correctly transfer your data as well as ensure everything is MTD ready to help you are compliant and under charge.

Why choose QuickBooks UK?

The UK-specific configuration: Chart of accounts Tax codes, VAT codes, rates, and the calendar aligned with HMRC rules.

Rapid migration: Move from Excel, Sage, Xero or Wave using clean balances from the past.

Real support, real people: UK hours, WhatsApp/email/phone, priority responses.

Expand With Confidence: Add payroll, inventory, projects and even multi-currency when you expand.

Secure first Banking-level encryption as well as roles-based access to your team.

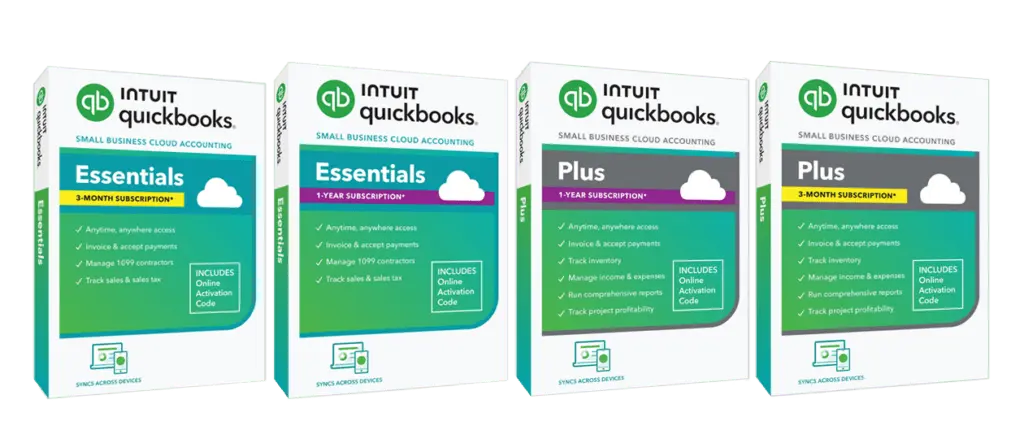

Get your license key via an email in just a few seconds following the checkout.

100% genuine It is activated through Intuit.

Pay once--no surprise renewals in our store, Life Time Activation.

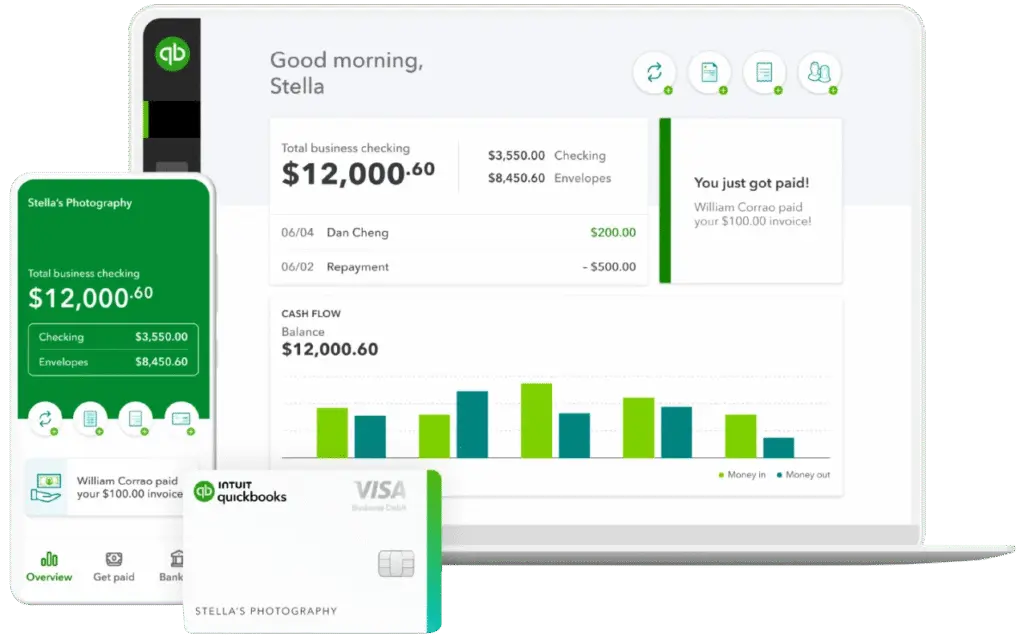

QuickBooks UK Easy Integration

QuickBooks UK bookkeeping made simple. Taxpayer, MTD-ready payroll invoices, bank feeds and invoicing. You can get setup, migration as well as priority assistance from UK experts.

You’ll love these integrations

Payments: Stripe, PayPal, GoCardless

Ecommerce: Shopify, WooCommerce, Amazon

Payroll & HR: BrightPay, Pleo, Staffology

Reporting: Excel/Google Sheets, Power BI

QuickBooks UK – Instant Delivery, Original Key, One-Time Purchase

QuickBooks UK licences with instant delivery, the original key and single-time purchase. UK installation Tax and payroll assistance are available.

tax-ready MTD (QuickBooks United Kingdom)

QuickBooks UK aids VAT-registered companies to maintain electronic records and submit VAT returns using the API of HMRC. This is important because Making Tax Digital requires software to manage the records specified and electronically submit VAT returns. No need for manually uploaded VAT returns. We set up VAT schemes and link to HMRC for filings that are tidy and in time.

Open Banking feeds from banks (QuickBooks UK)

In the Open Banking, QuickBooks UK can connect to the top UK banks to provide secure, reading-only feeds, allowing you to access instant cashflow as well as faster reconciliations. UK Open Banking is FCA-regulated and only authorized firms are able to participate. QuickBooks has an updated listing of the banks supported as well as alternative banks if a particular bank cannot be reached for any reason.

Payroll and RTI conformance (QuickBooks United Kingdom)

Running payroll within QuickBooks UK means PAYE, pension calculation, and NI calculations. All of this is done with RTI submittals for HMRC (FPS/EPS) directly from the software. The system will set up your payroll refs, set up the automatic FPS when needed and then test your payroll submission to ensure that it doesn’t turn into an emergency drill.

Security, data rights & control

Open Banking access is permission-based–you choose what to share and for how long. When combined with QuickBooks security features like bank-level encryption, and the ability to grant permissions to users at a granular level Your financial data remains within your reach while collaborators are granted access only to the data they require.

Integrations with that UK companies actually utilize

QuickBooks UK integrates with over 300 applications–think Shopify/WooCommerce to sell e-commerce products, payment systems such as Stripe or GoCardless and tools for reporting for board packs. So your profits, cash outs and charges are transferred to accounts that require less manual. The system will map tax codes and bank regulations so that your transactions are deposited in the correct nominal codes right from the first day of.

Do you need to act now? (penalties and regulations are increasing)

HMRC is continuing to increase the use of digital records penalty for late-filing. taxes on income and VAT are increasing. Therefore, getting QuickBooks UK set up correctly safeguards your cash while avoiding penalties. The bookkeeping we set up will be aligned to the current regulations, and inform you of changes with the latest developments in the framework.

It’s your offer, specifically clarified Choose QuickBooks UK with instant delivery, the original key as well as a one-time purchase through us. You can then you can add an optional UK installation, migration, and education. We’ll load customers, suppliers and the opening balances, join banks, setup VAT settings, and then prepare your first tax return to ensure you’re prepared and in compliance beginning week one.

Transparency and trust (important important note)

QuickBooks is an Intuit-developed product. We offer an independent license, setup as well as support in support of the QuickBooks UK but are not Intuit until explicitly stipulated. We are in compliance with FCA’s aligned Open Banking guidelines as well as HMRC MTD rules when configuring your system.